When beginning estate planning, one of the most common questions families ask is whether they need a will or a trust. While both tools serve important purposes, they function very differently — particularly when it comes to probate, privacy, and long-term asset protection.

Understanding the differences between trusts and wills helps Missouri families choose the planning structure that best protects their loved ones and simplifies estate settlement. This guide breaks down how each works and when one may be more appropriate than the other.

⭐ What Is a Will?

A will is a legal document that directs how your assets should be distributed after your death. It also allows you to:

- Name an executor

- Designate guardians for minor children

- Specify asset distributions

- Provide funeral instructions

However, a will must go through probate court before assets are distributed.

If you want to understand how probate works, see:

⭐ What Is a Trust

A trust is a legal structure that holds assets for the benefit of your beneficiaries. During your lifetime, you typically serve as trustee and maintain control of trust property.

After death or incapacity, your successor trustee administers assets without court supervision.

Trusts are commonly used to:

- Avoid probate

- Maintain privacy

- Provide incapacity planning

- Structure distributions

- Protect beneficiaries

Learn more about trust creation here:

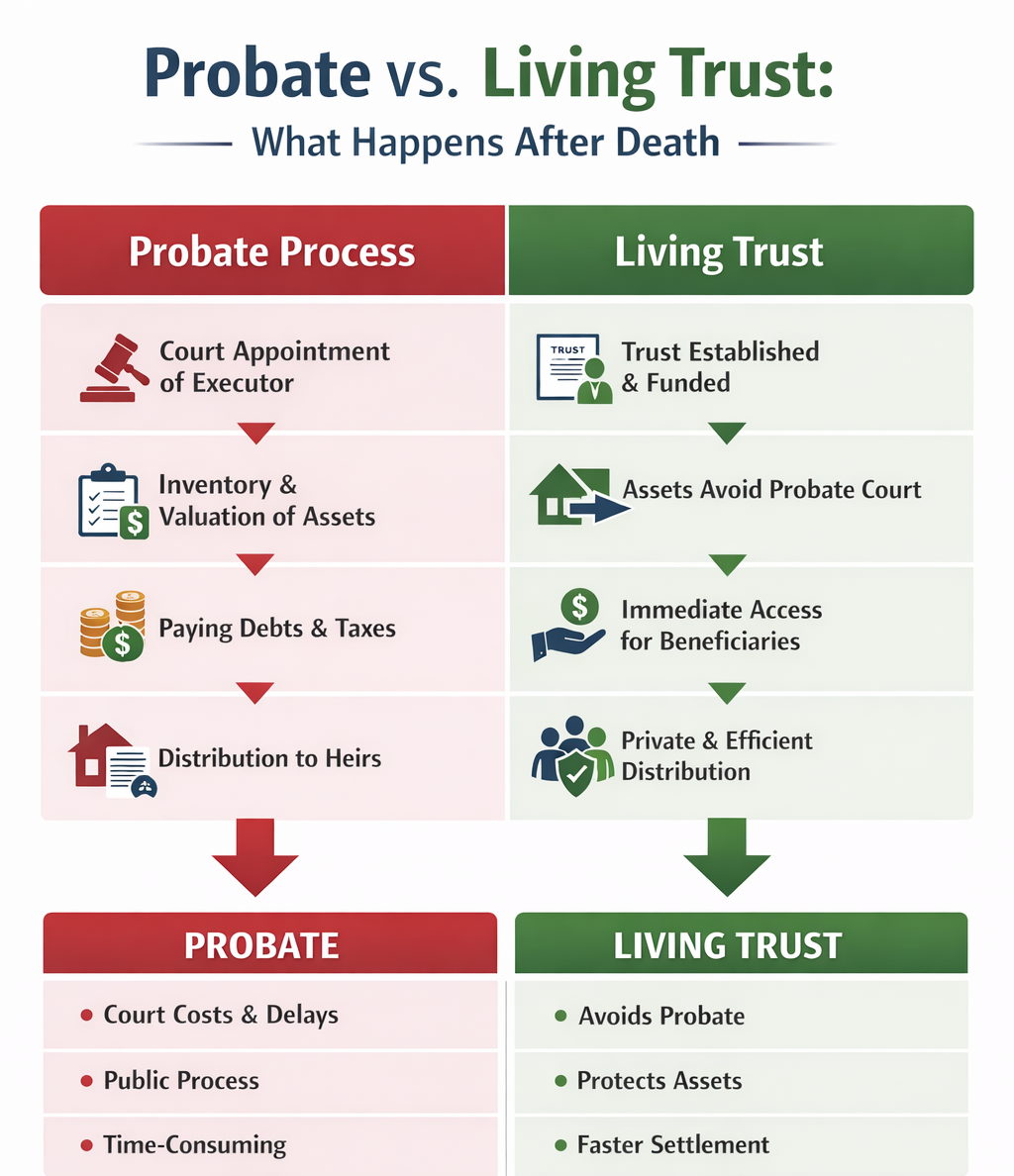

⭐ Probate: The Biggest Difference

The most significant distinction between wills and trusts is probate involvement.

Wills

Assets distributed under a will must go through probate, which may involve:

- Court filings

- Creditor notice periods

- Administrative fees

- Public proceedings

Trusts

Assets held in a properly funded trust pass outside probate, allowing faster and more private distribution.

Not Sure Whether You Need a Will or a Trust?

Not Sure Whether You Need a Will or a Trust?

Choosing the right structure depends on your assets, family, and planning goals.

Schedule a consultation to determine the best strategy for your estate plan.

⭐ Privacy Considerations

Probate is a public process.

That means:

- Asset values become public record

- Beneficiaries are disclosed

- Creditors receive formal notice

Trust administration, by contrast, remains private.

Families seeking discretion often prefer trust-based planning.

⭐ Incapacity Planning Differences

A will only becomes effective upon death.

It provides no authority if you become incapacitated.

Trusts, however, allow a successor trustee to manage trust assets during incapacity — without court guardianship.

Trusts are often coordinated with broader incapacity planning tools:

Cost Considerations

Wills

- Lower upfront cost

- Probate costs incurred later

Trusts

- Higher upfront planning cost

- Reduced or eliminated probate costs

Over time, trust planning may reduce overall estate settlement expenses.

Which One Do You Need?

The answer depends on your situation.

A Will May Be Appropriate If:

- You have limited assets

- You don’t own real estate

- Probate avoidance is not a priority

A Trust May Be Better If:

- You own real estate

- You want to avoid probate

- You have minor children

- You want privacy

- You want incapacity protection

Many estate plans use both — a trust plus a pour-over will.

Why Funding Matters in Trust Planning

Even when a trust is created, assets must be transferred into it.

An unfunded trust may fail to avoid probate.

Learn more about funding here:

Frequently Asked Questions

Do I need both a will and a trust?

Often yes. A pour-over will captures assets not transferred into your trust.

Does a trust completely avoid probate?

Only if assets are properly funded into the trust.

Is a will cheaper than a trust?

Upfront, yes. Long-term administrative costs may differ.

Can a will handle incapacity planning?

No. Wills only function after death.

Which is better for families with children?

Trusts often provide more structured protection and distribution control.

Choosing the Right Estate Planning Foundation

Both wills and trusts play important roles in estate planning — but they serve different functions.

By understanding probate exposure, privacy considerations, and incapacity protections, Missouri families can build plans that truly protect their legacy.

If you’re deciding between a will, a trust, or both, schedule a consultation to design the right structure for your family.

Comments are closed