Creating a trust is one of the most effective ways to protect your family, avoid probate, and ensure your assets are distributed according to your wishes. But many families don’t realize that signing a trust document is only the first step. For a trust to function properly, it must also be funded.

An unfunded trust can fail to avoid probate, delay asset distribution, and create unnecessary administrative burdens for loved ones. This guide explains how trusts work, how to create one, and why proper funding is essential to making your estate plan effective.

⭐ What is a Trust?

A trust is a legal arrangement where assets are held by a trustee for the benefit of designated beneficiaries. During your lifetime, you typically serve as trustee and retain control over trust assets. After your death or incapacity, your successor trustee steps in to manage and distribute assets according to your instructions.

Trusts are commonly used to:

- Protect beneficiaries

- Avoid probate

- Maintain privacy

- Provide incapacity protection

- Control distributions

⭐ Types of Trusts Used in Family Planning

Most families use revocable living trusts as the foundation of their estate plan. These trusts remain flexible during your lifetime but become irrevocable upon death.

Other trust structures may include:

- Irrevocable trusts for tax or asset protection planning

- Special needs trusts

- Minor’s trusts

- Asset protection trusts

If you want to explore advanced trust structures, find out more here:

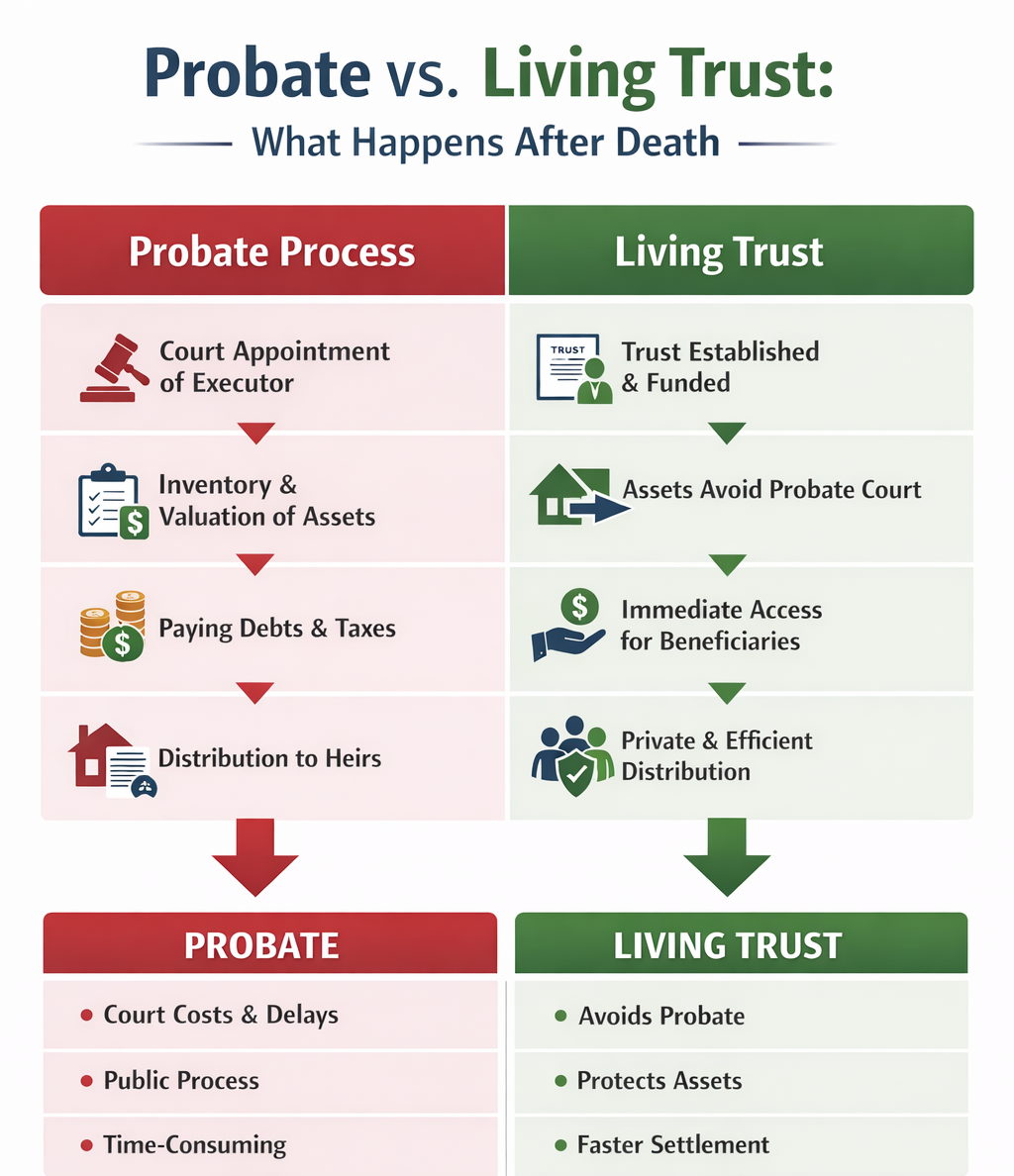

⭐ How Trusts Avoid Probate

Probate is the court-supervised process of administering an estate. While necessary in some cases, it can involve delays, court filings, creditor notice periods, and public proceedings.

Assets held inside a properly funded trust pass outside probate court, allowing your successor trustee to distribute assets privately and efficiently.

If you want a deeper breakdown of estate administration, see estate settlement:

⭐ The Trust Creation Process

Creating a trust involves more than drafting documents. A comprehensive process typically includes:

- Identifying assets and beneficiaries

- Selecting trustees and successor trustees

- Designing distribution terms

- Coordinating incapacity planning

- Executing trust documents

Professional guidance ensures your trust aligns with your financial and family goals.

Learn more about the planning process here:

Build a Trust that Actually Works

Creating a trust is only effective when it’s properly designed and implemented.

Schedule a consultation to begin building a trust tailored to your family’s needs.

⭐ What Is Trust Funding?

Trust funding is the process of transferring ownership of assets into your trust.

This may include:

- Real estate deed transfers

- Bank account retitling

- Brokerage account ownership changes

- Business interest assignments

- Personal property assignments

Until assets are transferred, the trust does not control them.

⭐ Why Funding Matters

Failure to fund a trust is one of the most common estate planning mistakes.

An unfunded or partially funded trust may result in:

- Probate court involvement

- Delayed distributions

- Increased administrative costs

- Confusion for beneficiaries

Proper funding ensures your trust operates as intended.

Learn more about common planning mistakes:

⭐ Assets Commonly Transferred Into Trusts

Typical funded assets include:

- Primary residences

- Rental properties

- Non-retirement investment accounts

- Bank accounts

- Business interests

Some assets — like retirement accounts — are coordinated through beneficiary designations instead of ownership transfers.

⭐ Ongoing Trust Maintenance

Trust funding is not a one-time event.

You should review funding whenever you:

- Open new financial accounts

- Purchase property

- Form businesses

- Refinance real estate

- Acquire major assets

Regular reviews ensure your trust remains fully operational.

Frequently Asked Questions About Trust Creation & Funding

Is creating a trust enough to avoid probate?

No. Assets must be transferred into the trust for probate avoidance.

What happens if I don’t fund my trust?

Assets left outside the trust may require probate administration.

Can I fund my trust myself?

Yes, though many clients retain professional assistance for deeds and assignments.

Do retirement accounts go into a trust?

Typically no — they are coordinated through beneficiary designations.

How often should trust funding be reviewed?

At least annually or after major financial changes.

A Trust Only Works If It is Funded

Creating a trust is one of the most powerful steps you can take to protect your family — but funding is what makes the plan effective.

By properly transferring assets and maintaining funding over time, Missouri families can avoid probate, simplify estate settlement, and preserve their legacy.

If you’re ready to create or fund your trust, schedule a consultation to begin.

Comments are closed